Location Matters: Geographic Factors in Car Insurance

When it comes to car insurance in Canada, where you live plays a significant role in determining your premiums. Understanding these geographic factors can help you make informed decisions about your coverage and potentially save money.

Why Location Affects Your Car Insurance

Insurance companies consider various location-based factors when calculating premiums:

- Population density

- Traffic patterns

- Crime rates

- Weather conditions

- Accident statistics

Urban vs. Rural Areas

Generally, urban areas tend to have higher insurance rates due to increased traffic, higher accident rates, and greater risk of theft. Rural areas often enjoy lower premiums, but may face other risks like wildlife collisions.

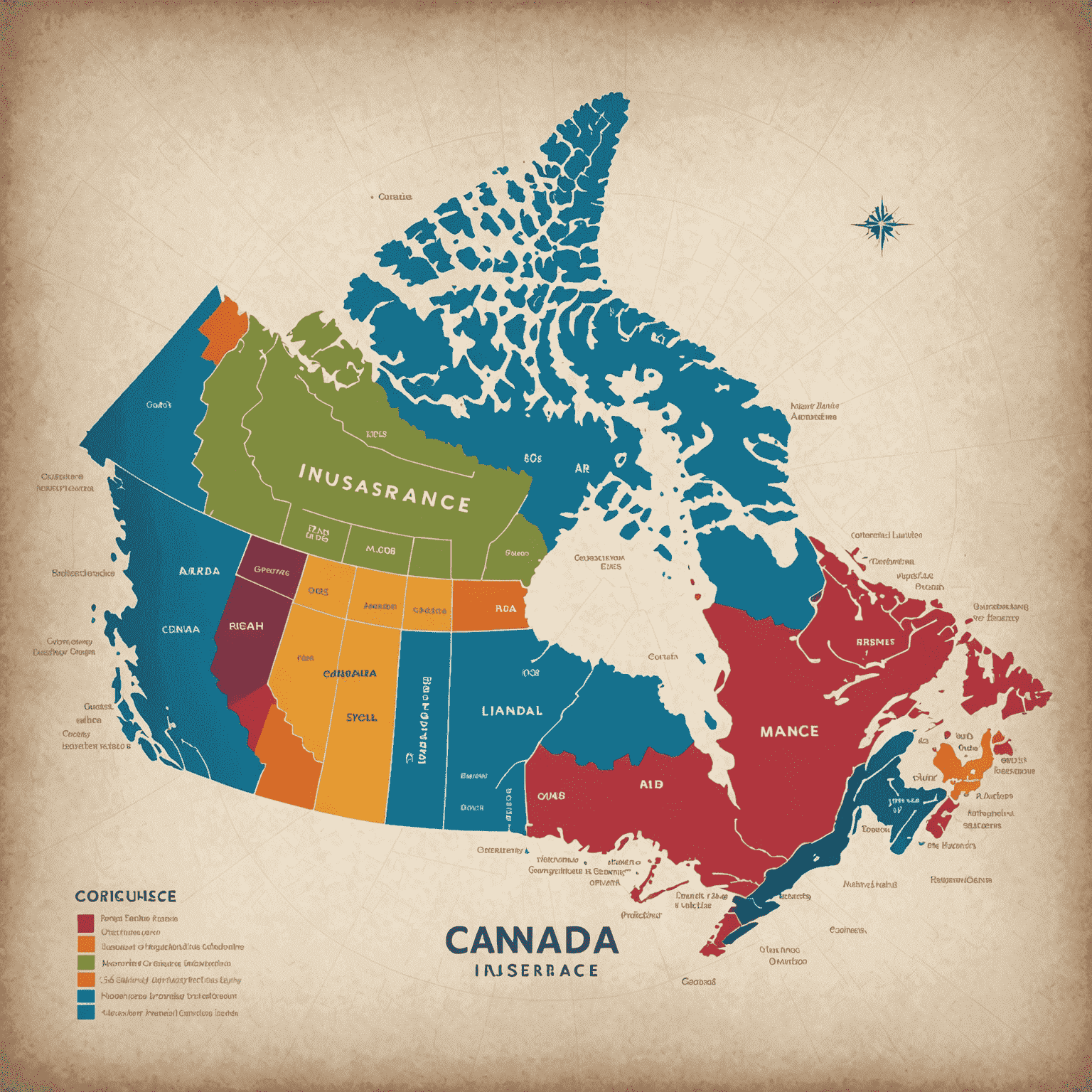

Provincial Differences

Insurance regulations and average premiums can vary significantly between provinces. For example:

- British Columbia, Saskatchewan, and Manitoba have government-run insurance programs

- Ontario and Alberta typically have higher average premiums

- Quebec often has lower rates due to its hybrid public-private system

Neighborhood Factors

Even within cities, different neighborhoods can have varying insurance rates based on:

- Local crime statistics

- Proximity to busy intersections

- Availability of secure parking

Climate Considerations

Canada's diverse climate also plays a role in insurance costs:

- Areas prone to severe weather (e.g., hail in Alberta) may see higher premiums

- Regions with harsh winters might have increased rates due to higher accident risks

What Can You Do?

While you can't change your location, you can take steps to mitigate its impact on your car insurance:

- Shop around and compare quotes from different providers

- Consider a higher deductible if you live in a high-risk area

- Install anti-theft devices if vehicle crime is a concern in your neighborhood

- Take advantage of any available discounts, such as multi-vehicle or bundling policies

Understanding how your location affects your car insurance can help you make informed decisions and potentially find ways to reduce your premiums. Remember, while location is important, it's just one of the many factors that influence your car insurance costs in Canada.